Taxes Setup

The Taxes Setup setting is available at the location level only.

If your location charges for rates, fuel, or incidentals, you may need to tax any of these items. Use the Taxes Setup management setting to define the taxes and surcharges (or flat fees) that apply to charges in your state/province, county, or municipality.

Note: Any changes you make only apply to new appointments and agreements, going forward; current booked appointments and open agreements are not affected.

- On the Rates tab, find and edit (

) the Taxes Setup setting for your location.

- Click the add button (

) to begin adding a new tax.

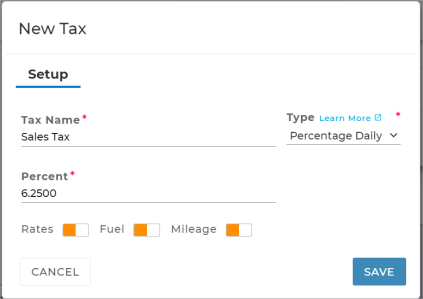

- Enter a Tax Name and select a Type of tax, if different than the default of Percentage Daily.

- Depending on the type of tax, enter the Percent or Flat Fee amount.

- For Percentage Daily taxes only, if you want this tax to apply to your location's rates, fuel charges, and mileage charges on new agreements, select the Rates, Fuel, and/or Mileage options. (Flat taxes are applied to any agreement on which a rate is applied.)

- Click to add the new tax.

- Click to save the Taxes Setup management setting.

- On the Rates tab, find and edit (

) the Taxes Setup setting for your location.

- Click the edit button (

) to edit a tax.

- Make your changes, and click .

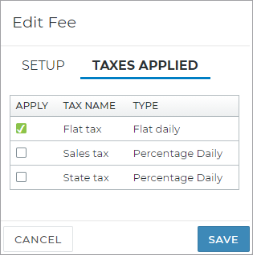

You can apply one or more of your taxes to a specific additional fee within the Fees Setup setting. (For example, if you want a Detail Fee to be taxed only by your state and sales taxes.)

- On the Rates tab, find and edit (

) the Fees Setup management setting. The Taxes Applied column lists any taxes already applied to a fee.

- Click the edit button (

) to edit a fee, or the add button (

) to add a new fee.

- On the Taxes Applied tab, select the check boxes for the taxes you want to apply to the fee, and click and to update the fee.

- Click to save the management setting.

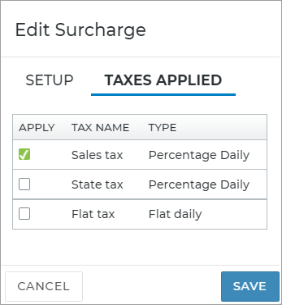

If you have one or more surcharges set up, you can apply one or more of your taxes to the surcharge within the Surcharge setting. (For example, if you want a 3% Surcharge fee to be taxed only by your Sales Tax.)

- On the Rates tab, find and edit (

) the Surcharge setting. The Taxes Applied column lists any taxes already applied to the surcharge.

- Click the edit button (

) to edit a surcharge, or the add button (

) to add a new surcharge.

- On the Taxes Applied tab, select the check boxes for the taxes you want to apply to the surcharge, and click and to update the surcharge.

- Click to save the setting.

- On the Rates tab, find and edit (

) the Taxes Setup setting for your location.

- Click the delete button (

) to delete the tax.

- Click .

Glossary of terms

Flat Fee

For Flat daily taxes, the Flat Fee field is available for you to enter the flat amount that is applied to taxable charges.

Percent

For Percentage Daily tax types, the Percent field is available for you to enter the percentage of tax applied to taxable charges.

Rates, Fuel, and Mileage options

These options are only available for Percentage Daily types of taxes.

If you want a daily percentage tax to be applied to your location's rates, fuel charges, and mileage charges on new agreements, select the Rates, Fuel, and/or Mileage options.

Tax Name

The unique name of the tax, up to 15 characters.

Type

When setting up a tax for your location, you must define the type of tax, from the following options:

- Percentage Daily. Calculated as a percentage of the total charges, regardless of the length of the agreement.

- Flat Daily. A flat fee that is applied once each day of the agreement, as long as a rate has been applied to the agreement. For example, if you set up a $2.00 Flat Daily tax, an agreement with a length of three (3) days would accrue $6.00 in flat taxes.

© 2026 TSD Rental, LLC

>

>