Credit Card Processing

Contact your TSD Sales Representative at sales@tsdweb.com to get started with TSD DEALER's integrated Credit Card Processing.

With TSD DEALER's integrated credit card processing, you can securely collect a customer's credit card and bill for agreement charges (i.e., rates, fuel, mileage, and fees), and/or toll charges, if you have Toll Processing.

Credit card transactions are performed on an 'iFrame', a secure dialog on which all cards on file are assigned a ‘token,’ or a unique code that replaces sensitive PCI card data. The system stores only the card token, protecting sensitive card data against misuse.

Note: If you use Toll Processing integration only (i.e., credit card processing for toll charges only, not for agreement charges), you can only capture a credit card for the purposes of charging for tolls, not agreement charges. See "TSD Toll Connect: Toll Processing" for more information about toll processing.

To view a tutorial for this topic from the web application, click the Tutorials icon ( ), or to view a list of available tutorials.

), or to view a list of available tutorials.

Setup Requirements

- Configuration for this integration must be performed by TSD. Contact your TSD Sales Representative at sales@tsdweb.com for more information.

- Set up rates, a fuel charge, taxes, and additional fees, as applicable. See "Rates, Charges, Fees & Taxes Setup" for more information.

- Charging for fuel? Make sure the Fuel Capacity (tank size) is accurate for your fleet. That way, you'll ensure accurate fuel charge calculations when the unit is returned.

- (Optional.) Require a credit card at open agreement. Make sure a card is captured on every new agreement via the Credit Card Capture Required at Open and Pre-Authorization Settings management setting.

- (Optional.) Turn on pre-authorizations and set default authorization amount(s). Enable pre-authorizations against the captured credit card via the Credit Card Capture Required at Open and Pre-Authorization Settings management setting. A Pre-Authorize toggle will be available on the agreement, and if left toggled on when saving the open agreement, a pre-authorization will be automatically taken against the captured credit card for agreement charges (non-tolls) and, if applicable, a separate pre-authorization for toll charges.

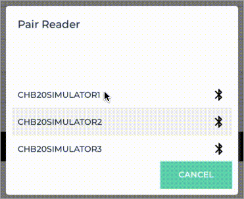

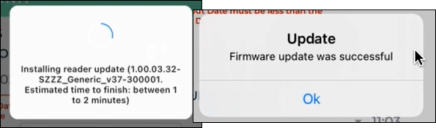

- (Stripe) Pair your card readers, if applicable. Once your Stripe account is set up and you’ve received your hardware, you must pair your M2 Stripe Readers in the mobile app, so they can be used during the agreement process on mobile devices.

- (Optional.) Turn off credit card capture on types of expedited appointments. For locations with Expedited Appointments, the Enable Credit Cards on Expedited Appointments setting is turned on, by default, for your appointment types, so the customer can submit a credit card for future payment. You can choose to turn off this setting for one or more appointment types, so the Credit Card Details and button are not present.

![]() How to pair a Stripe Reader M2 with your mobile device and install firmware updates:

How to pair a Stripe Reader M2 with your mobile device and install firmware updates:

Credit Card Processing in TSD DEALER

With integrated Credit Card Processing, a customer's credit card can be added to an appointment or agreement, so your location can easily bill for agreement charges, such as rates, fuel, mileage, taxes, etc., and/or toll charges, depending on your integration.

All cards on file are assigned a ‘token,’ or a unique code that replaces sensitive card data. The system stores only the token, protecting sensitive card data against misuse.

Capture a Credit Card

Capturing a credit card on an appointment or agreement is the first step to charging. From there, you can pre-authorize the card to hold funds for charges, save the card to the customer's profile, and bill for toll charges, depending on your exact integration.

A payment will not be taken against a captured credit card until you close the agreement.

- For locations with the Credit Card Capture Required at Open Agreement management setting turned on, capturing a credit card is required to complete the open agreement process. For employee roles with the Allow Override Credit Card Capture permission, capturing a card is optional.

- After an agreement is opened, if the customer later chooses to pay with a different card, or you need to make the card funds available for any other reason, changing the credit card at any point before the agreement is closed will release (reverse) the previous unused pre-authorization taken for rates, fuel charges, fees, and taxes, associated with the old card. (If a toll pre-authorization was taken, it will "fall off" of the card in a certain amount of time, depending on the individual credit card merchant.) At the time the card is changed on the agreement, a new pre-authorization will be taken for main agreement charges and for future toll charges, if applicable. See "Take a Pre-Authorization" for more information about how pre-authorizations work.

Capturing a credit card on an appointment or agreement is performed using an iFrame: a secure, embedded dialog on which all cards on file are assigned a ‘token,’ or a unique code that replaces sensitive PCI card data.

- On the appointment or agreement, click ,

- In the credit card capture iFrame, enter the required billing information.

- Click .

- If successful, a token is generated for the credit card and the card is added to the agreement, replacing any previous card associated with the agreement. Key card information (card type, last four digits, and expiration date) is displayed (e.g., visa: xxxx-xxxx-xxxx-4747 Exp. 05/28).

- Now that a credit card is captured on the agreement, you may have several other options, depending on your integration and employee role's permissions:

- Have a pre-authorization automatically taken against the card for charges (at save, if opening a new agreement, or at the time the card is captured, if viewing an agreement). Toggle on Pre-Authorize.

- Save this credit card to the customer's record for future appointments and agreements. Toggle on Save Credit Card to Customer Profile.

- Bill the credit card for any future toll charges incurred on the agreement. Toggle on Bill Toll Charges.

Note: The iFrame and required fields may differ, depending on your credit card provider. The name and address may be filled in from the appointment or agreement, if present. If you need to reload this iFrame, click .

Hover to view the full-sized image.

Hover to view the full-sized image.

Hover to view the full-sized image.

Credit card captures are logged in the agreement history (Credit Card), accessible via the History button on the side panel of an agreement. See "Agreement History (Event Logging)" for more information.

With the mobile app, you can capture a credit card on agreement by manually entering card information or, if supported by your credit card provider, a supported mobile card reader. See "Supported Devices and Peripherals" for more information about supported devices.

Note: The default method of credit card entry (manual or device) is based on your mobile settings ( ).

).

- On the agreement, choose whether you want to manually enter a card, or use a supported card reader.

Manually enter a credit card:

Manually enter a credit card: - Tap .

- In the credit card capture iFrame, enter the required billing information.

- Tap . If successful, a token is generated for the credit card and the card is added to the agreement, replacing any previous card associated with the agreement. Key card information (card type, last four digits, and expiration date) is displayed (e.g., visa: xxxx-xxxx-xxxx-4747 Exp. 05/28).

(CenPOS) Capture a card using an ingenico ICMP mobile card reader:

(CenPOS) Capture a card using an ingenico ICMP mobile card reader:

(Stripe) Capture a card using a mobile card reader.

(Stripe) Capture a card using a mobile card reader.

- Now that a credit card is captured on the agreement, you may have several other options, depending on your integration and employee role's permissions:

- Have a pre-authorization automatically taken against the card for charges (at save, if opening a new agreement, or at the time the card is captured, if viewing an agreement). Toggle on Pre-Authorize.

- Save this credit card to the customer's record for future appointments and agreements. Toggle on Save Credit Card to Customer Profile.

- Bill the credit card for any future toll charges incurred on the agreement. Toggle on Charge Violations to Customer.

Take a Pre-Authorization

Pre-authorizations are only available based on the Credit Card Capture Required at Open and Pre-Authorizations Settings management setting (Enable Pre-Authorizations toggle).

A pre-authorization is a temporary hold placed by a credit card merchant on a customer's card to reserve funds for future payment.

As part of your integration, you can set up your location to have a pre-authorization of a configured amount taken against the captured card (at save, for new agreements, or when a card is captured, for edited agreements), as long as Pre-Authorize is toggled on.

If you use credit card processing for agreement charges and tolls, these pre-authorizations are taken separately, based on your setups.

- If you use credit card processing for agreement charges, the pre-authorization amount is a flat amount on every agreement, or an additional amount over the cost of the total charges, depending on your setup.

- If you use credit card processing for toll charges, the pre-authorization amount is a flat amount on every agreement, to be reserved for possible future toll charges that may be incurred.

Note: After an agreement is opened, if the customer later chooses to pay with a different card, or you need to make the card funds available for any other reason, changing the credit card at any point before the agreement is closed will release (reverse) the previous unused pre-authorization taken for rates, fuel charges, fees, and taxes, associated with the old card. (If a toll pre-authorization was taken, it will "fall off" of the card in a certain amount of time, depending on the individual credit card merchant.) At the time the card is changed on the agreement, a new pre-authorization will be taken for main agreement charges and for future toll charges, if applicable. See "Take a Pre-Authorization" for more information about how pre-authorizations work.

Pre-authorizations are only available based on the Credit Card Capture Required at Open and Pre-Authorizations Settings management setting (Enable Pre-Authorizations toggle).

- Capture a credit card on the agreement. During the open agreement process, or while editing the opened agreement, capture a credit card to be pre-authorized. See "Capture a Credit Card".

- Turn on the Pre-Authorize option. Toggle on Pre-Authorize, if not selected by default; if opening a new agreement, the pre-authorization will not be performed until save.

- Complete (save) the open agreement. At save, the system automatically processes a pre-authorization on the customer's card. The total pre-authorized amount is displayed next to the card details. This amount includes both the main pre-authorization for rates, fuel charges, fees, and taxes, as well as the secondary pre-authorization for toll charges, if applicable.

Note: The application displays a pre-authorization error message if the pre-authorization attempted against a credit card is declined, so you can collect another form of payment, if needed. (For example: "No credit card on file" or "Failure trying to submit transaction for Credit Card Processing - Your card was declined.")

Take a Payment

Note: This feature is not available if you have Toll Processing only (i.e., credit card processing for toll charges only, not agreement charges), since charging for tolls is automated when tolls are incurred. See "TSD Toll Connect: Toll Processing" for more information.

Payments can be processed against a captured credit card at close agreement, or after an agreement is closed (for newly-added fees only).

If a pre-authorization was taken, these funds, up to the amount due, will be used as payment.

You can process a payment against a card when closing the agreement, or after an agreement is closed (for newly-added fees only).

- Begin the close agreement process. Fill out the returning information and review charges and fees, as needed.

- Add or change the credit card, if necessary. Capture a credit card to be charged. See "Capture a Credit Card" for instructions.

- Choose whether to pre-authorize the captured credit card. If your location is set up to take pre-authorizations, select the Pre-Authorize toggle. (The actual pre-authorization will be processed at save.) See "Take a Pre-Authorization" for more information.

- Choose who is responsible for toll charges: the customer or your location. If your location is set up for Toll Processing, you can toggle on Bill Toll Charges to charge tolls to the customer's credit card, or leave it off to bill them to your location. See "TSD Toll Connect: Toll Processing" for more information.

- Process the payment. Click . On the Submit a Payment dialog, adjust the payment amount, if necessary; by default, the payment is set to the amount owed by the customer. Click to process the payment, either directly on the card or from a pre-authorization, if one was taken.

- If the payment is successful, the Total Due is updated to 0.00, and a Payments row is added to the Charges grid.

- Complete your close agreement process.

Note: In order to process a payment, the Total Due for the customer must exceed $0.49, due to a $0.50 transaction fee on the location or dealer side.

When viewing a closed agreement on which a payment has been taken, a Payments grid is available with transaction details. The grid includes such information as the type (payment or refund), date of the transaction, card type, card number (last four (4) digits of the card), expiration date and amount (paid or refunded).

In the Payments grid, you can print or email receipts for payments and issue refunds, if necessary.

If you need to issue a payment refund, you can do so when viewing a closed agreement.

- In the Payments grid, click next to the payment, available as long as a full refund hasn't already been issued for that payment.

- On the Refund dialog, adjust the Refund Amount, as needed, and click . The Payments grid is updated with the refund (negative payment) record.

Print or Email Invoices & Receipts

You can generate an invoice for charges billed to a customer and/or charges billed to a company (for split invoices) after an agreement is closed, in the Charges section of the agreement.

- Click or .

- If this is a split invoice, select the customer or company invoice, or choose Print All / Email All to print / email each invoice on its own page.

- If emailing, verify the email address, if different than the one used on the agreement.

- Click (if printing) or (if emailing).

You can generate receipts for payments and refunds, as well as for toll violation charges (see "Credit Card Processing"), after an agreement is closed.

- To email a receipt PDF to a customer, click in the Payments or Toll Violations section of a closed agreement. Verify the email address, if different from the one used on the agreement, and click .

- To print a receipt PDF, click .

Credit Card Processing for Tolls

Locations with Toll Processing along with Credit Card Processing can automatically bill the customer for toll violation charges incurred on the agreement, or leave these toll violation charges to be paid for by the dealership. See "TSD Toll Connect: Toll Processing" for more information.

Frequently Asked Questions

You can set up rates, charges, fees, and taxes in the Rates tab of the Admin Hub. See "Rates, Charges, Fees & Taxes Setup" for more information.

You can capture a credit card anytime during the agreement process, but you can only process a payment:

- during the close agreement process or Quick Return.

- after the agreement is closed, for any newly-added fees.

You can print or email an invoice to the customer or to a company (for split invoices), or print or email a payment receipt to a customer after an agreement is closed.

See "Print or email an invoice" and "Print or email a receipt for payments" for more information.

When a toll violation is received, TSD DEALER matches the date and time of the toll violation to the agreement's date range1 for the unit, based on the transponder ID, if available, or the license plate and state, in order to identify the correct agreement & customer to be charged.

- The customer's card on file is billed if: a match is found and Bill Violation Charges (Charge Violations to Customer on mobile) was selected on the agreement.

- The dealership's card is billed if:

- a matching agreement is found and Bill Violation Charges or Charge Violations to Customer was cleared.

- no matching agreement is found.

- the customer's card was charged, but the card was not present or results in a declined charge.

- the agreement was an Internal Use agreement.

Yes! It works just like it does on the web.

Locations with Credit Card Processing provided by Clutch (Stripe) or CenPOS can take pre-authorizations. For these locations, if the Enable Pre-Authorizations option within the Credit Card Capture Required at Open Agreement management setting is enabled, a pre-authorization is taken on the agreement. See "Take a Pre-Authorization" for more information.

- Closed Contract Accounting report to view a breakdown of all charges billed to the customer’s card, as well as payments, refunds, and toll violations for closed agreements.

- Dealer Credit Card Reconciliation report to view dealer payments for toll violation charges.

If the Bill Toll Charges option was selected on the agreement, a Toll Violations grid is available on the closed agreement with details of any toll violations incurred on the agreement. These may take up to ten (10) days after the agreement was closed to display. See "View payments on a closed agreement".

Best Practices

The following are tips and recommendations when using Credit Card and Payment Processing. See "Best Practices: TSD Connect (Credit Card Processing for Rates, Fuel and Tolls)" for more information.

Fill in required credit card information fields. When capturing a credit card, the First Name, Last Name, Country, Address, City/Town, State, Card Number, Expiration (MM/YY), CVC and Zip Code are all required. (When Toll Processing is also enabled, the customer's email address is required to save a customer record, appointment, and agreement.)

Keep customers informed. You, the merchant, must disclose initial pre-authorized and charged amounts and fees to cardholders.

If a card is declined, do not attempt additional charges. Doing so will flag the processor and you may incur increased processing fees. Additionally, these repeated attempts to authorize a declined card may create bank-initiated chargebacks. Refer to the card issuers' websites for recommendations on avoiding chargebacks.

Additional charges on the same card may be taken automatically on the same agreement for toll charges. With toll processing, the customer's credit card is charged for any toll charges incurred on the agreement, ten (10) days after the agreement is closed. Additional charges on the same card may be taken automatically on the same agreement for any additional tolls, as applicable.

© 2026 TSD Rental, LLC

) >

) >